NFTs explained and FAQ

NFTs have a very bad reputation. “Have you paid for that? You’re paying for a jpeg! I have already copied it”. Today, I want to make you understand what they’re and what are the possibilities that it brings. To make you understand NFTs we’ll explore the concept of fungibility, some technical details, digital scarcity, what’s special about NFTs, use cases, and some frequent questions answered.

Fungibility

NFTs stands for Non-Fungible Token. First, you need to understand what is fungibility. It means that something is interchangeable without anyone noticing, the value and properties are the same. Dollars are fungible, no one cares which exactly dollar bill you have but how many. Dollars are fungible. A nonfungible would be something that is unique and cannot be interchanged. For example a painting. All paintings are different even if you try to print them exactly the same way. Other examples would be lottery tickets, any collectible or properties. Nonfungible tokens are tokens that are unique, unlike bitcoin and ether which are fungible tokens.

Technical definition and details

From a technical perspective, NFTs are a generic name but they usually refer to the Ethereum standard that implements NFTs which is ERC-721 that has been widespread over other blockchains also. ERC-721 also implies a smart contract interface to interact with those tokens. Using a standard is useful for developers to easily create infrastructure and applications on top by reusing code.

The data of the token is usually a JSON file that contains the token metadata and a link to a decentralized hosted asset (image, video, whatever) through IPFS or another similar protocol. This metadata can be read in the contract by using tokenURI interface.

This means that what’s actually in the blockchain is just an entry in the blockchain with a URI that points to that file, so the blockchain doesn’t actually contain the actual NFT data. But if the data is stored in a decentralized storage blockchain like IPFS then yes, the data is in the blockchain but in another one, not in Ethereum.

The CryptoPunks smart contract was the precursor of the standard. Their deviated version from the ERC-20 was the starting point. They were early also in the technical side.

For the data, they used a clever approach. They uploaded the image with all punks on the internet and stored the hash in the smart contract. An easy way to link all images to a single entry in the smart contract.

Minting an NFT

To create an NFT you mint it. You execute an operation of an ERC-721 compatible smart contract and a new unique token is created. There are platforms that allow you to mint your custom NFT such as Opensea, Rarible, Foundation, or Zora. Collections like Bored Ape Yacht Club have their own compatible smart contract and they can have custom settings.

You need to understand that minting a custom NFT is one thing and minting an NFT from a collection is another thing. Minting a custom NFT would be creating your token with your own data and minting from a collection is creating a new token of that collection which is usually generated (you don’t choose the contents of the NFT).

Embedded markets

Another feature NFTs have is that as they’re native to the blockchain, they can be easily traded. This enables a dynamic market and reduces headaches to creators that otherwise would need to create its selling page, setting up payments, etc. Instead, an NFT is automatically available to trade at all NFT platforms or privately.

Trading an NFT is similar to trading a fungible token like ether. The smart contract has a record saying that your wallet address owns a token ID and it has an interface to update the record to a new wallet address. An NFT market smart contract can act as an escrow to allow safe trades. You can check opensea.io as an example.

Digital scarcity

NFTs allow creating digital scarcity. Creating digital scarcity has been a struggle for the digital industry over the years. Companies have tried to stop distributing free copies of games, videos, and music with many techniques that eventually get hacked. This has led to new business models in the industry such as streaming and free-to-play models to try to monetize in different ways.

Until now, that was never done before outside of a closed garden. The most important examples are video games like Fortnite. By creating unique collectibles that you can wear in-game, they have become one of the top revenue-making videogames of all time. For newer generations, having digital unique assets is something natural. This alone is telling you that the market will be huge.

Digital scarcity also creates new incentives for people to create unique pieces where you can put a lot of effort knowing that no one will be able to steal your work. Will we see a new creative renaissance with those incentives?

What is special about an NFT

NFTs are equivalent to a unique real-world piece in the digital world with some special features.

- Verified authorship. Enforced proof in the blockchain.

- Verified authenticity. Through provenance that cannot be modified. If token authorship comes from the verified author then the piece is authentic.

- Verified ownership. Ownership and its history is stated in the blockchain.

- No degradation. As long as the blockchain is active and the metadata is pinned, the NFT won’t degrade.

- Embedded markets. Native digital trading enabled.

- Composability. By creating new smart contracts tokens can interact between them and create new ones or grant new utilities.

- Advanced features. Special features can be imbued to the tokens based on development of new smart contracts and dApps like ENS domains.

Use cases

The most popular use case nowadays is digital art, but there are many enabled use cases right now and more to come.

- Collectibles and digital art – opensea.io, an open marketplace of NFTs.

- Crowdfunding and donations – mirror.xyz, a crypto blogging platform supporting crowdfunding, donations and auctions with NFTs.

- Identification mechanism – ens.domains, the decentralization of DNS and online identification.

- Community ownership and participation – Veefriends, a privileged community around Gary Vaynerchuk.

- Decentralized franchises – Bored Ape Yacht Club gives IP rights to owners and people are creating all kinds of merch and derivated art making them a decentralized franchise run by its owners.

- Proof of attendance – Poap gives badges to people that are present in certain events as a proof.

- Lottery tickets – Many NFTs collections use each NFT as a lottery ticket when creating new raffles.

Crypto Art – Use case highlight

The current mainstream use case of NFTs is crypto art. Many artists are coming to the space to try to make a living out of their pieces. They enable small collectors, investors, and artists to freely collaborate. Before NFTs, investing in art was a sophisticated way of investing available mostly for people with lots of money. NFTs have broken the barrier and you can invest and collect meaningful art for lower prices it also enables digital collections similar to what people were doing with real-life counterparts. They also give confidence to collectors and investors as they can audit the smart contract and history to value NFTs according to their criteria. They’re also enabling new types of art that previously were not considered such as small dance clips.

NFTs FAQ

What’s an NFT?

A special kind of token that represents a unique entity in the blockchain. It features verifiable authorship and ownership, embedded markets, and benefits of blockchain capabilities.

Why people buy NFTs?

Depending on the token, there are multiple reasons someone would want to buy an NFT. It depends on the use case.

- As buying a collectible or art.

- As an investment: waiting for the price go to up to make some money.

- Utility: access to a private community, future drops, own commercial rights of a franchise, participate in NFT enabled games…

- Supporting an artist.

- As a status symbol.

- Other use cases.

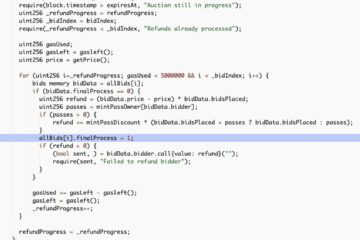

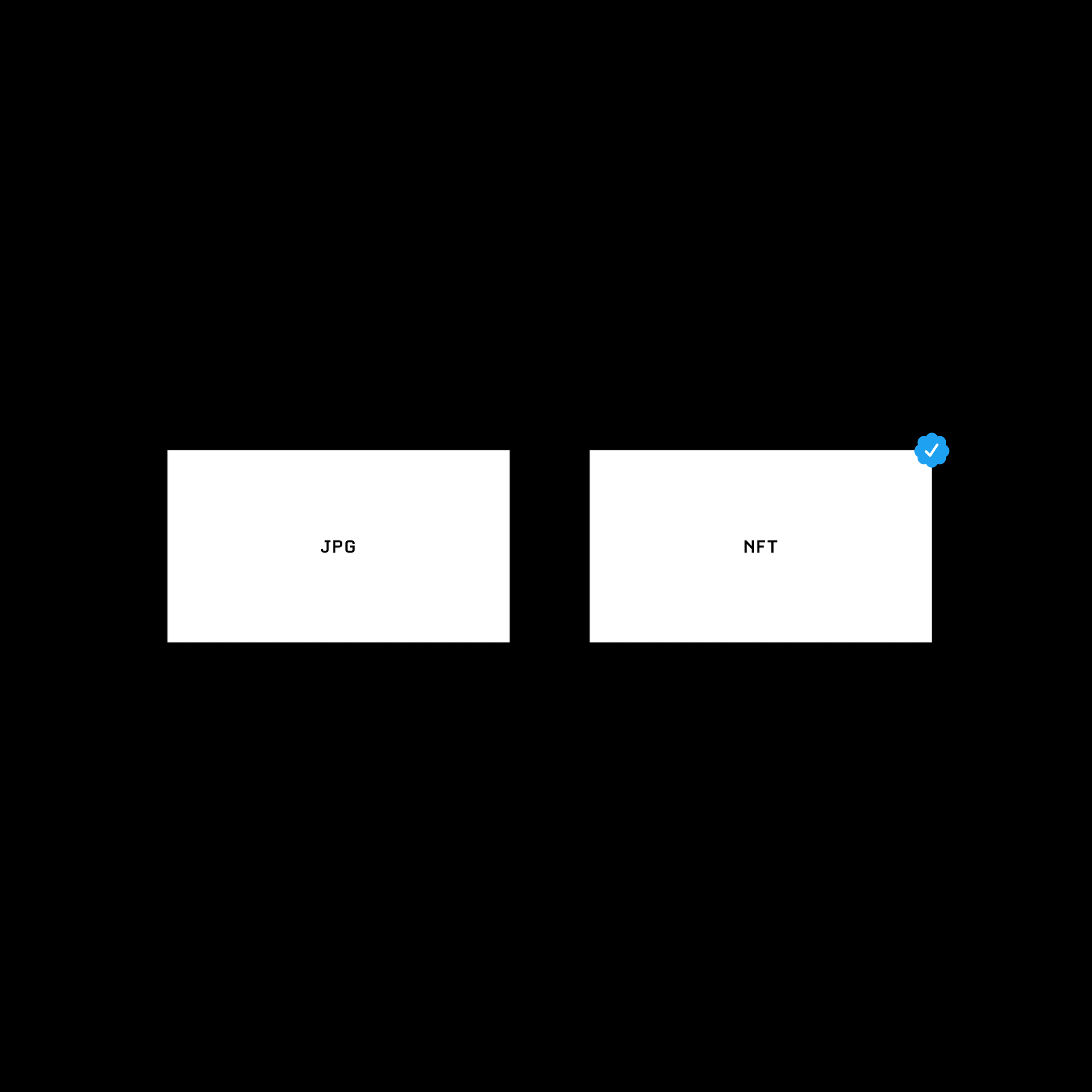

I just copy-pasted the JPEG, I’m a hacker?

No, you don’t. The same way people take a picture of the Mona Lisa or just print it doesn’t mean they have it. This is the same.

Why minting on Ethereum?

It’s the most popular smart contract platform and the de-facto place to mint even though is not cheap. Ethereum has the biggest ecosystem and security and that’s what makes an NFT more valuable on Ethereum than in other blockchains. In the future, when cross-chain compatibility is more advanced, we could trade NFTs between blockchains. Lately, blockchains such as BSC and Polygon have become popular for their cheap fees.

What are the costs of minting NFTs?

Creating a custom NFT has the transaction costs of creating the token. They depend on the platform and smart contract used. If gas cost is at 20 gwei it would be between 0.004 and 0.01 ether. There are different platforms that allow you to mint your NFT in their smart contract (Opensea, Rarible, Foundation, Zora, etc.). Another way is to deploy a custom smart contract and mint there your NFTs (only for developers). When minting an NFT of a collection, minting usually has a fee called mint price independent of the transaction costs that are set up by the collection creator.

Are NFTs contributing to the climate crisis?

NFTs are not special inside the Ethereum blockchain. The power usage of the Ethereum blockchain is independent of what you do on it. It depends on things such as miners’ hardware efficiency and current hash rate. Impact also depends on the miners’ energy sources which are hard to measure. Basically, NFTs are no different than other operations in the blockchain. Nevertheless, is expected that Ethereum moves to PoS in less than a year that would radically reduce its power usage and environmental impact.

Action points

If you want to dig a little bit more I propose you some action points.

- Visit an NFT on opensea and check its trading history: check authorship, ownership, and transactions.

- Visit the CryptoPunks gallery.

- Review an NFT collection smart contract on Etherscan: read smart contract data and smart contract code.

- Visit Foundation to see latest trending NFTs on the platform: see what is happening right now on the market.

- Read more stuff about NFTs.

Cover image: NFTs, explained by Jack Butcher. Sold for 74 ether.